Frustration With IRS Delays In Employee Retention Tax Credit

Services

Overview of the Employee Retention Tax Credit

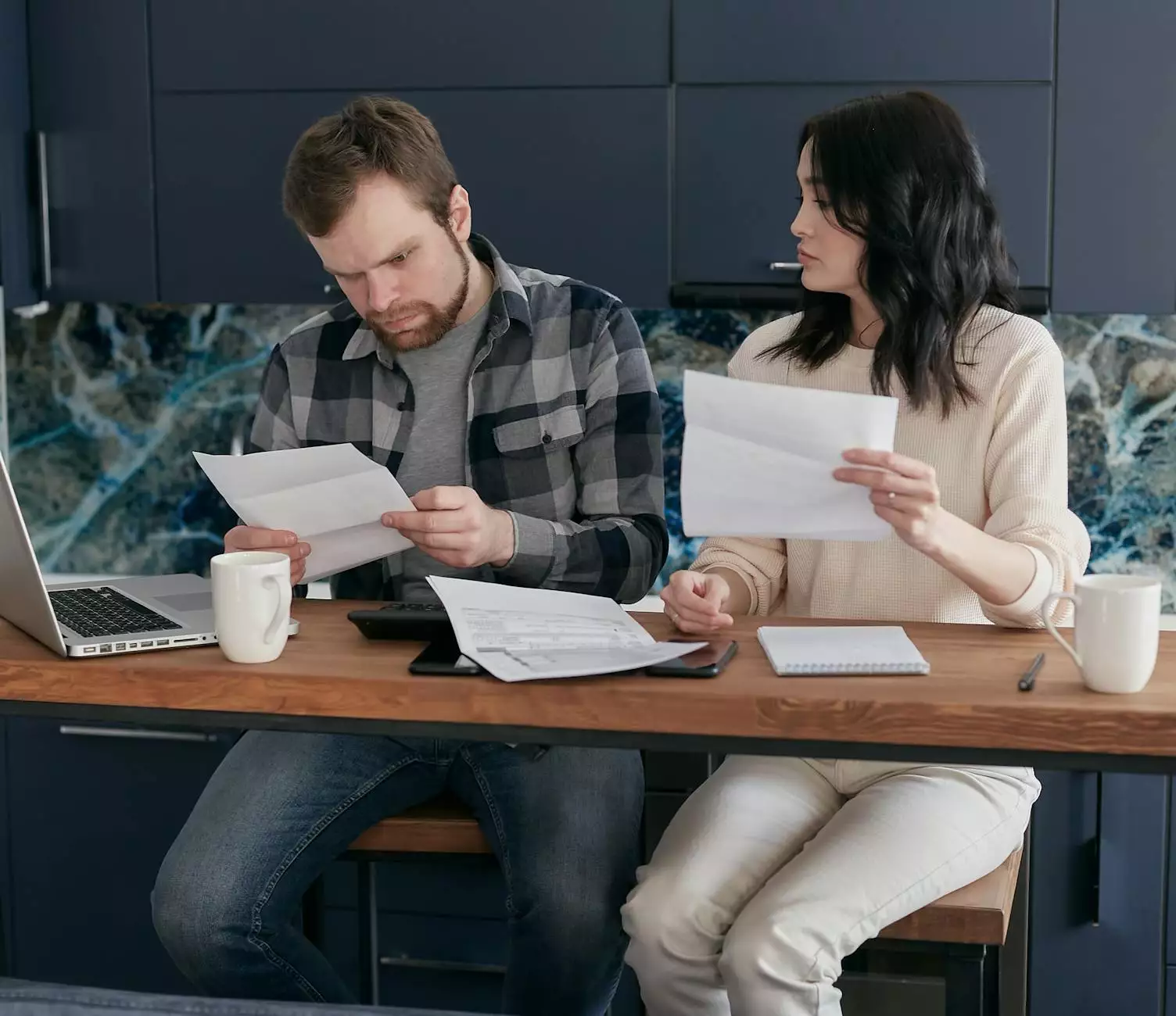

The Employee Retention Tax Credit (ERTC) has been an essential support for businesses, especially amidst uncertain economic conditions caused by the COVID-19 pandemic. It allows eligible employers to claim a tax credit for retaining their employees and helps them navigate through financial challenges. However, frustration arises when there are delays in receiving the tax credit from the IRS.

Understanding the Importance of Employee Retention

Employee retention is crucial for the success and stability of any business. By retaining skilled and experienced employees, businesses can maintain productivity levels, reduce recruitment costs, and foster a positive work environment. The ERTC aims to incentivize employers to retain their workforce, supporting both the employees and the broader economy.

The Impact of IRS Delays on Businesses

Unfortunately, the IRS delays in processing and disbursing employee retention tax credits have been a source of frustration for many businesses. The delays can create financial strain, making it challenging for employers to support their employees and cover essential operational costs. The uncertainty surrounding the timing of receiving the tax credit adds to the burden businesses already face.

Common Challenges and Concerns

1. Administrative Burden

Businesses often face significant administrative burdens when dealing with the ERTC. They need to navigate complex eligibility criteria, gather relevant documentation, and complete lengthy application processes. The additional burden of IRS delays exacerbates this challenge, causing frustration and impacting cash flow.

2. Financial Strain

IRS delays can have a severe financial impact on businesses, particularly small and medium-sized enterprises with limited resources. These delays can disrupt cash flow, hinder investment opportunities, and hinder business growth. It is essential for businesses to receive the tax credit in a timely manner to maintain financial stability.

3. Uncertainty and Planning

Planning is vital for businesses to make informed decisions and set realistic goals. However, the prolonged delays in receiving the ERTC from the IRS make it difficult for businesses to plan effectively. Uncertainty around when the credits will be processed and received can hinder growth strategies and present challenges in budgeting and forecasting.

How to Handle IRS Delays

While IRS delays in processing employee retention tax credits can be frustrating, there are actions businesses can take to manage the situation:

1. Stay Informed

Regularly monitor official IRS updates and announcements regarding the ERTC delays. Staying informed will help you understand the current status and any potential changes.

2. Communicate with Professionals

Consider reaching out to tax professionals, accountants, or legal advisors who specialize in tax matters. They can provide valuable guidance on how to navigate through the challenges posed by IRS delays and ensure compliance with all necessary requirements.

3. Prioritize Financial Planning

Given the uncertainties surrounding the timing of the tax credit, it is crucial to prioritize financial planning. Create contingency plans, explore alternative sources of funding, and maintain a realistic cash flow forecast to mitigate the impact of IRS delays.

4. Advocate for Change

Engage in advocacy efforts to highlight the issues faced by businesses due to IRS delays in processing employee retention tax credits. Collaborate with industry associations, business networks, and other stakeholders to collectively raise awareness and push for timely and efficient processing.

Contact Landed for Support

At Landed, we understand the frustration that businesses experience due to IRS delays in the ERTC. As a trusted partner in the real estate industry, we are here to support you in navigating through these challenges. Our team of experts can provide guidance on managing financials, strategizing for growth, and accessing alternative resources. Contact us today to learn how we can assist you!